Following the gangbusters year the housing market had, questions are forming about what’s going to happen with housing prices and interest rates going forward.

While we can’t predict with 100% accuracy, there are some important metrics you can keep your eye on that will give you a good idea about where the housing market may be headed as we move through the year.

1. INTEREST RATES

As the inflation rate has been increasing over the last year, we have seen interest rates move higher. Experts anticipate seeing them continue to increase between now and the summer, but then taper down as the Federal Reserve removes stimulus and increases short-term interest rates. This will force the stock market to correct and cause money to move into the bond market which is where mortgage-backed securities are sold.

So, for the first half of the year you can anticipate seeing higher interest rates, which is already starting to happen. As the economy cools off in the second half of the year, expect to see see those rates start to come down a bit.

2. INVENTORY

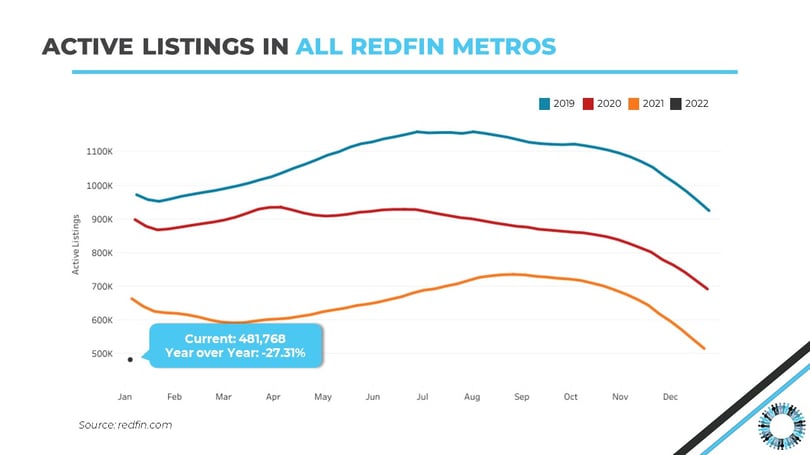

We are beginning the year with over 27% less housing inventory than we had at the start of 2021.

Housing inventory has been trending downward consistently, so the fact that we have less than last year is not alarming. However, according to Redfin there are only about 428,000 homes listed for sale across the entire United States. That is DRASTICALLY less than what we would expect if we are following historical trends.

This limited supply means we are going to continue to see appreciation, but higher interest rates will cool off homebuyer slightly. Even still, you can expect to see average appreciation hover around 8% nationally.

3. POPULATION MOVEMENT

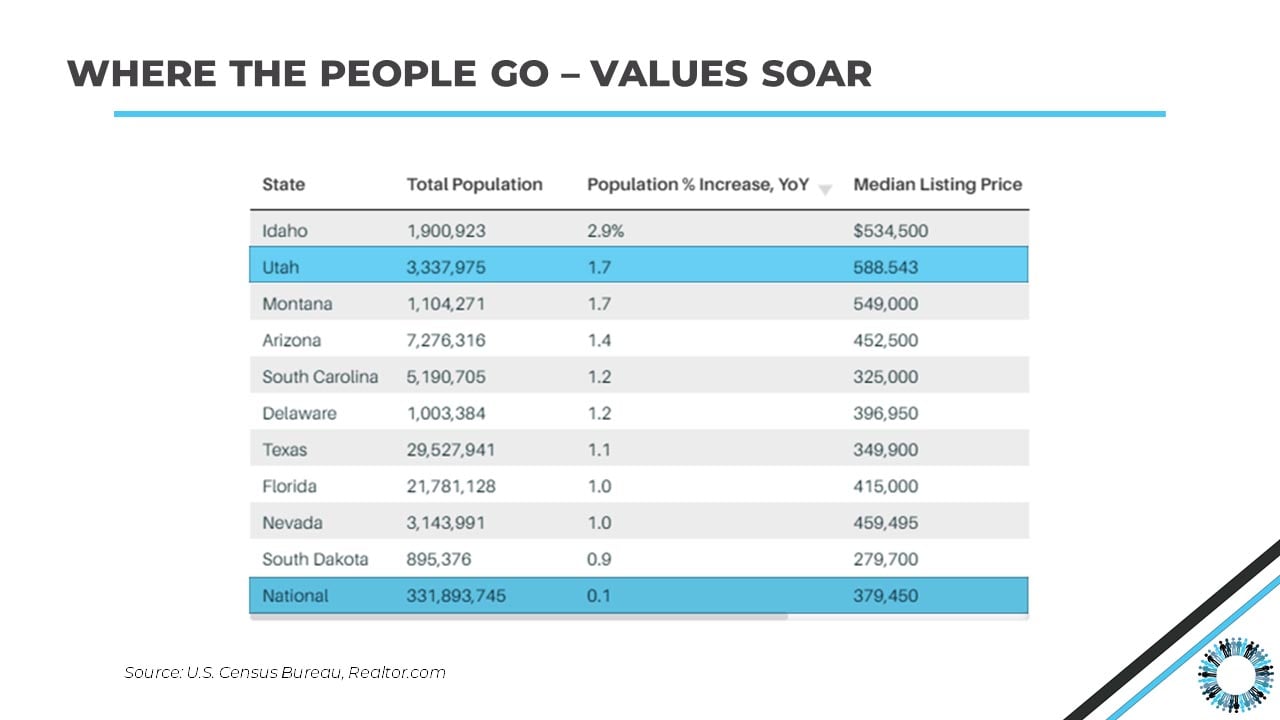

Some states are experiencing higher than average population growth. At a time when population growth in the United States has fallen to a historically low rate, the Intermountain West has become one of the fastest growing regions in the country.

According to U.S. Census data, Idaho was the fastest-growing state with 2.9% growth from 2020 to 2021. Utah and Montana tied for second at 1.7%, followed by Arizona, at 1.4%.

These states have booming economies and more room to spread out. Consequently, they are going to see higher levels of appreciation.

4. CHANGING DEMOGRAPHiCS

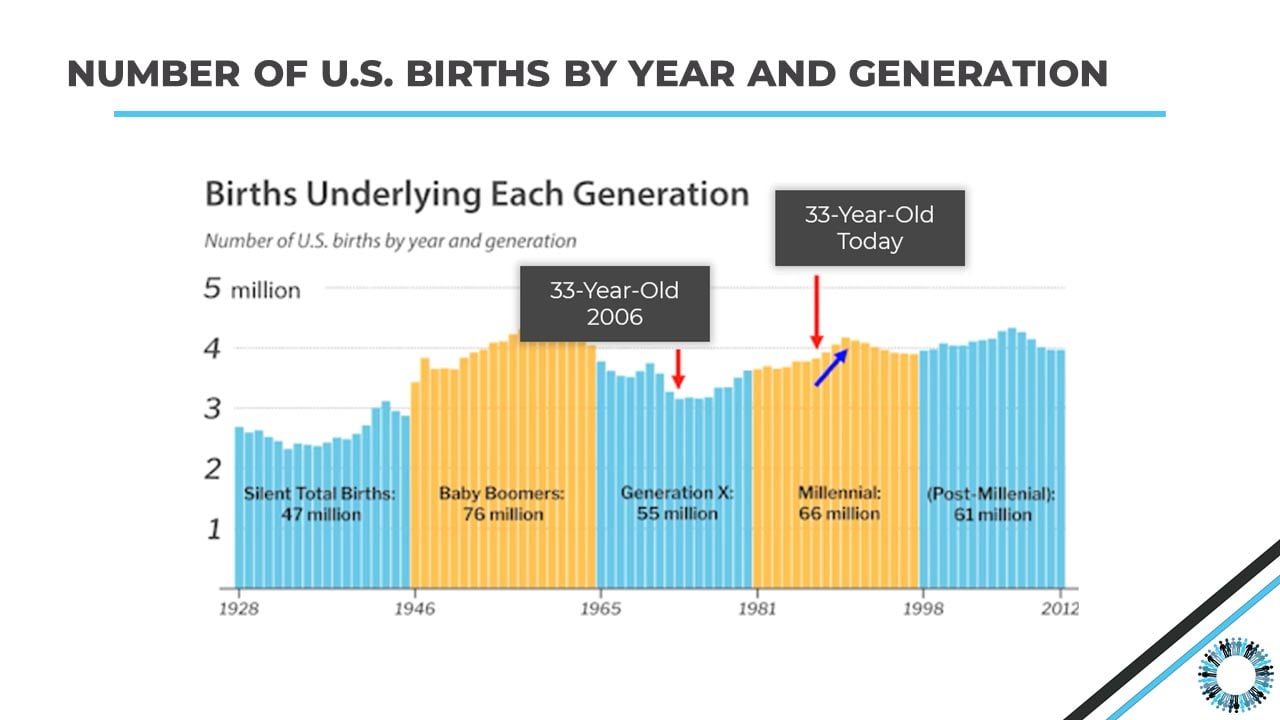

2022 will bring the highest number of home sales since the housing boom of 2006. Why? Because more millennials are buying homes.

The average American homeowner purchases their first home at the age of 33. By following the U.S.-birth chart below, we can see the population of 33-year-olds today (people born in 1989) is surging and anticipated to bring more first-time buyers to the market over the next four years.

After the 1990 birth rate peak, we see a mild pullback in birth rate but with numbers still elevated near 4 million. This indicates we have another 4 years of significantly improving demographics and higher demand from first time homebuyers.

5. MORE HOMES BEING BOUGHT WITH CASH

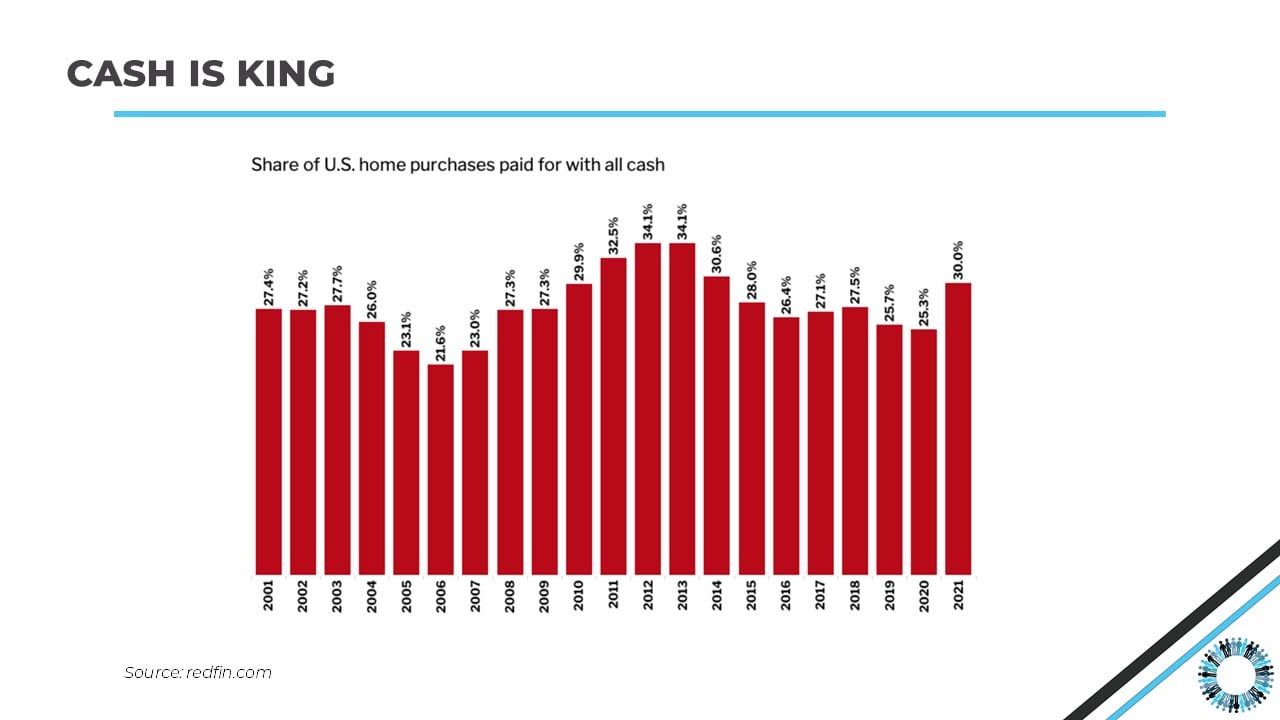

A study by Redfin found that 30% of U.S. home purchases in the beginning of 2021 were all cash. That trend is going to continue to increase this year and we will see nearly one third of all homes being bought with all cash.

With inventory so limited, buyers are realizing they need to offer cash to compete. This is driven not only by competition from other homebuyers, but investors backed by large investment funds. These companies know that inflation and housing demand are going to continue to push rents higher and they are seeing the dollar signs.

6. THE BOTTOM LINE

Stable demand for housing spurred by low inventory and more homebuyers entering the market means we are going to continue to see a booming market with consistent appreciation, albeit at a lower rate than the last two years.

If buyers want to succeed in the housing market this year, they need to submit the most competitive offer possible considering where these trends are heading. This means having a solid pre-approval letter from their lender and being able to offer cash to compete with investors who are flooding the market.

Submit a comment