A lot of media outlets are still saying we are about to see a repeat of the 2008 housing market crash. Well, we disagree, and we have the statistics to back it up.

What is happening in the housing market today is a normalizing of two years of out-of-control buyer demand and insufficient home supply, but it is still the farthest thing from a 2008 redux.

What’s more, the current real estate climate fueled by fears of a crash is creating huge opportunities for homebuyers. Let’s explore why.

Supply and Demand Following 2008

For the housing market to crash and home prices to fall drastically, there would need to be a large surplus of supply and very low demand.

The supply-demand landscape of the housing market is typically very balanced, which is why prices have always trended upward. There are very few exceptions to this, with 2008 being the most glaring. Unusually high supply and unusually low demand led to the largest housing crash in history.

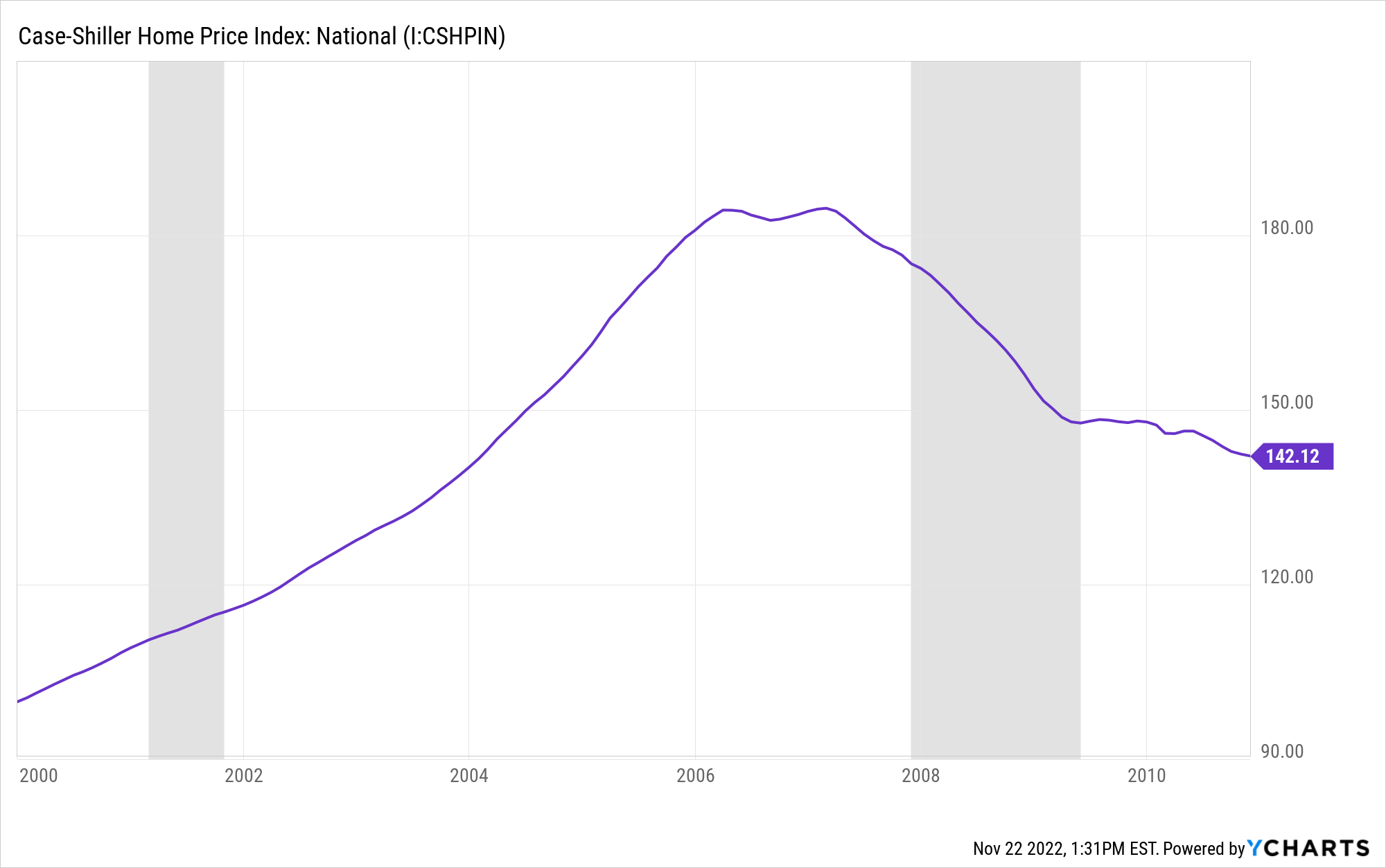

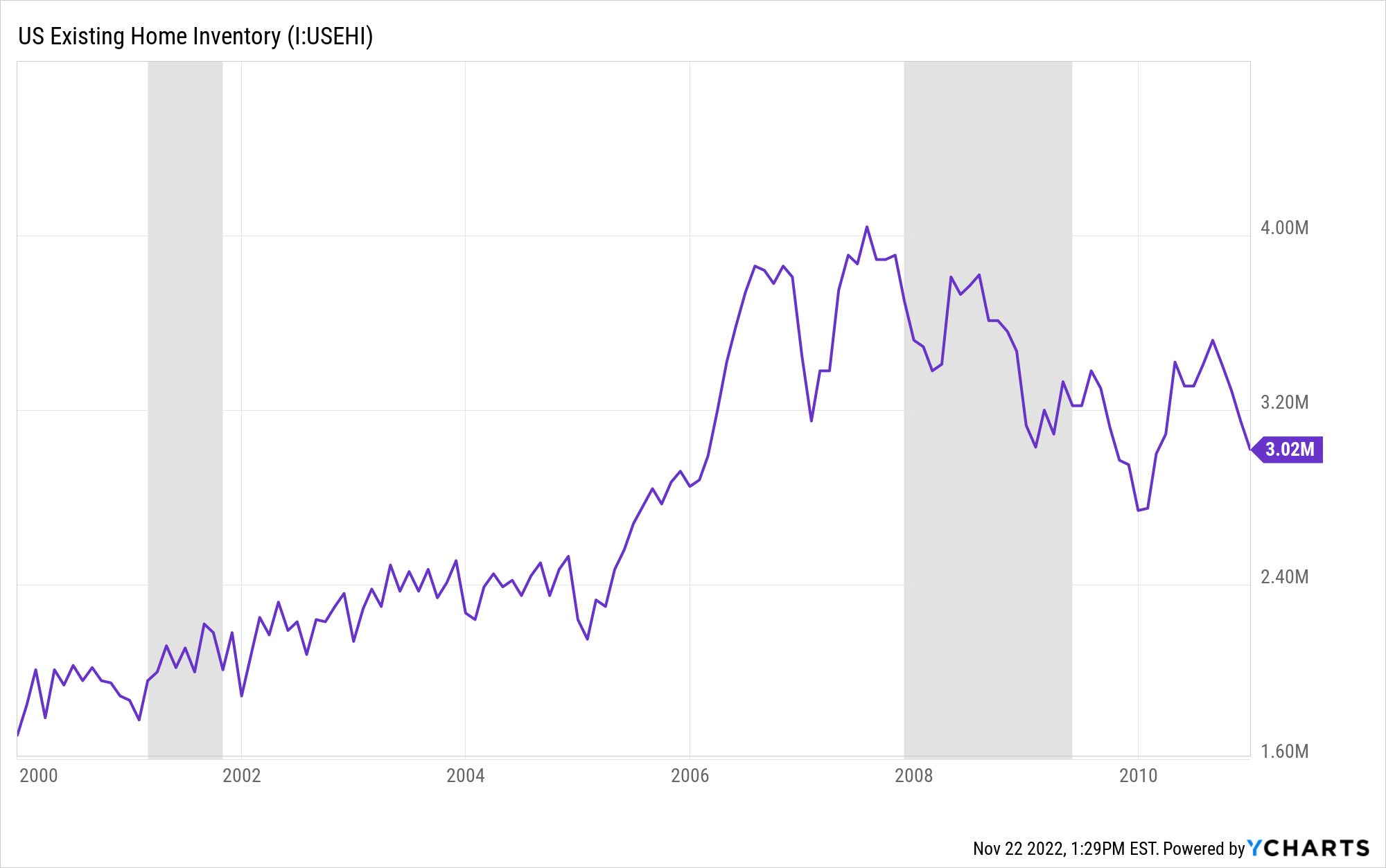

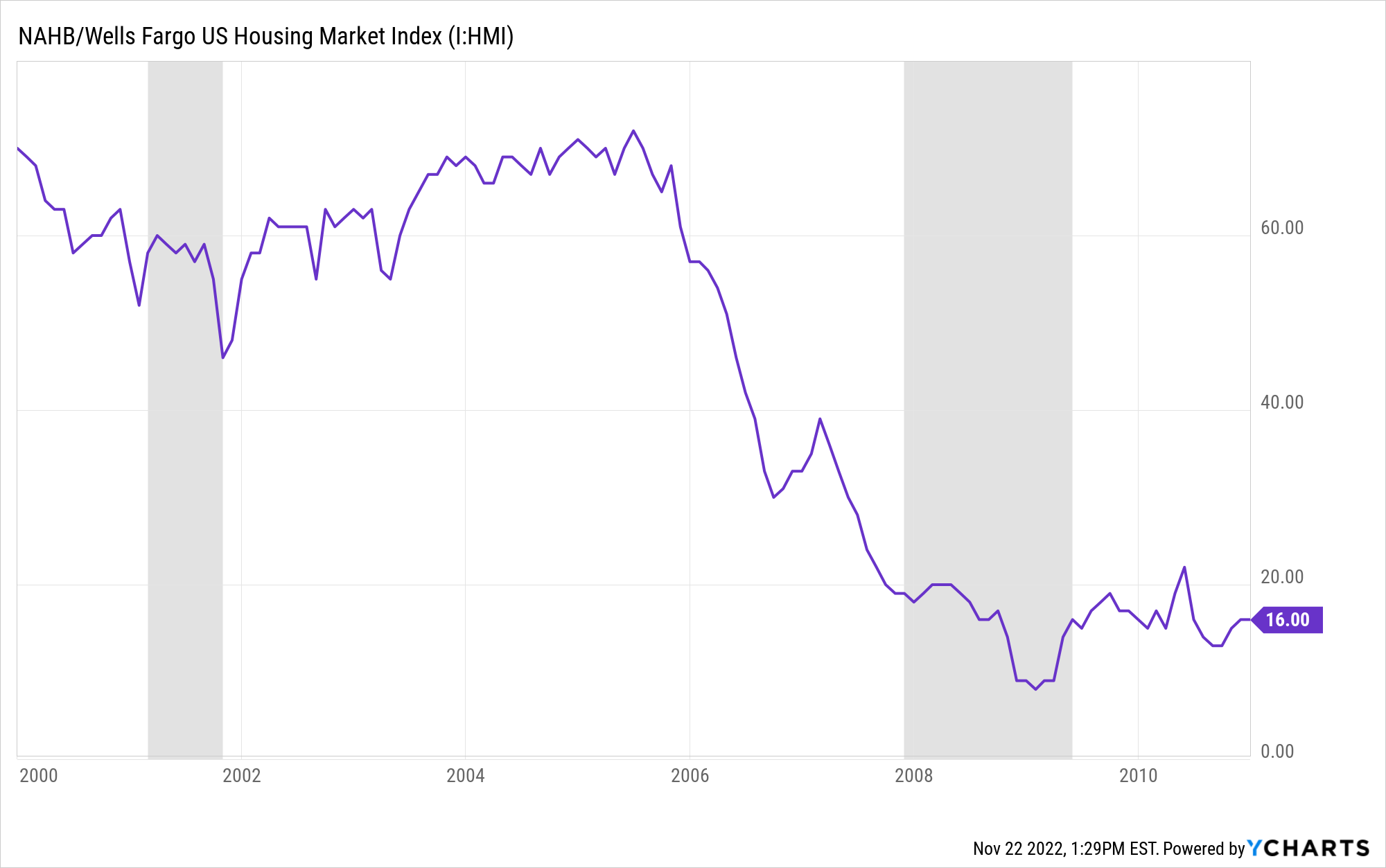

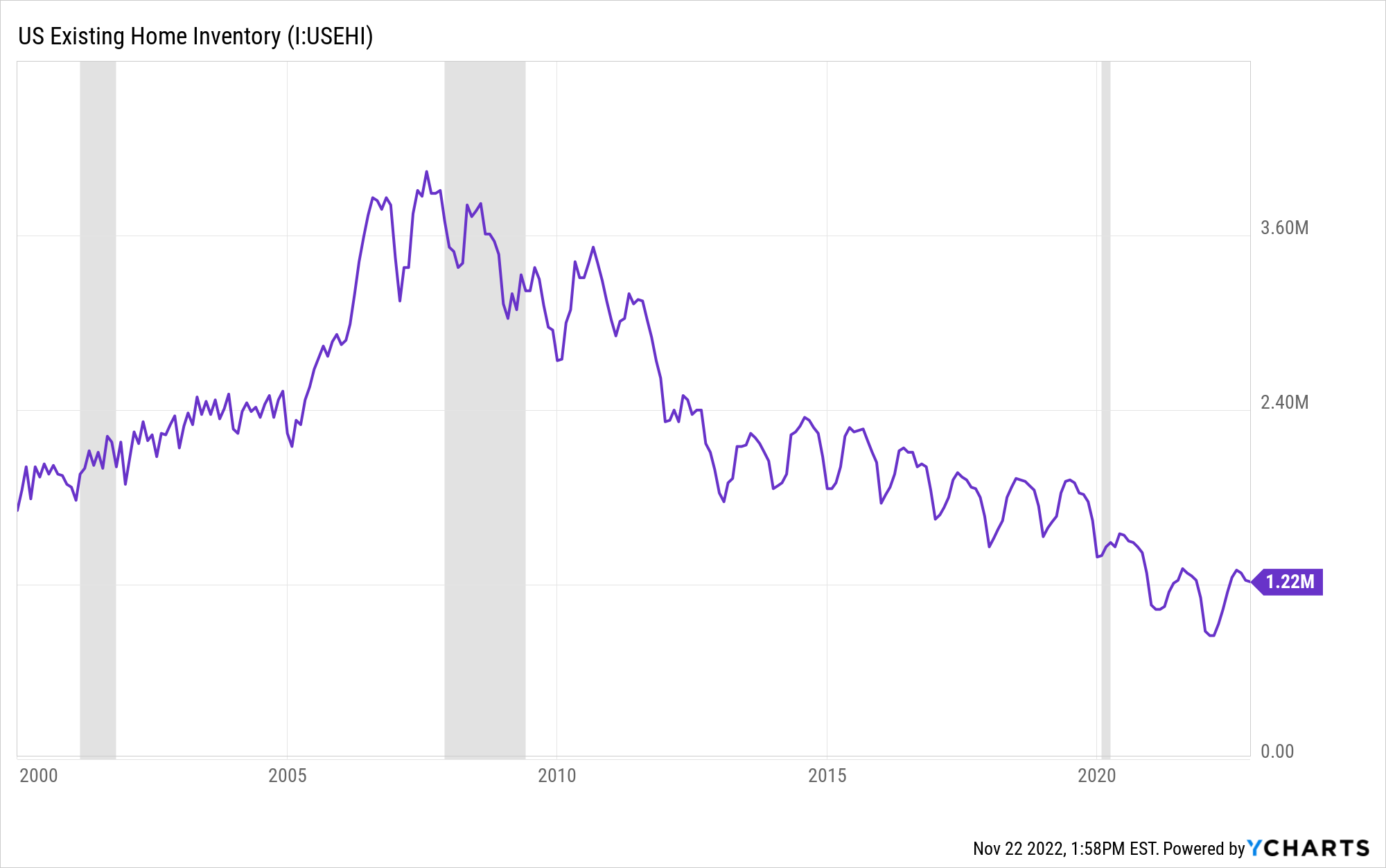

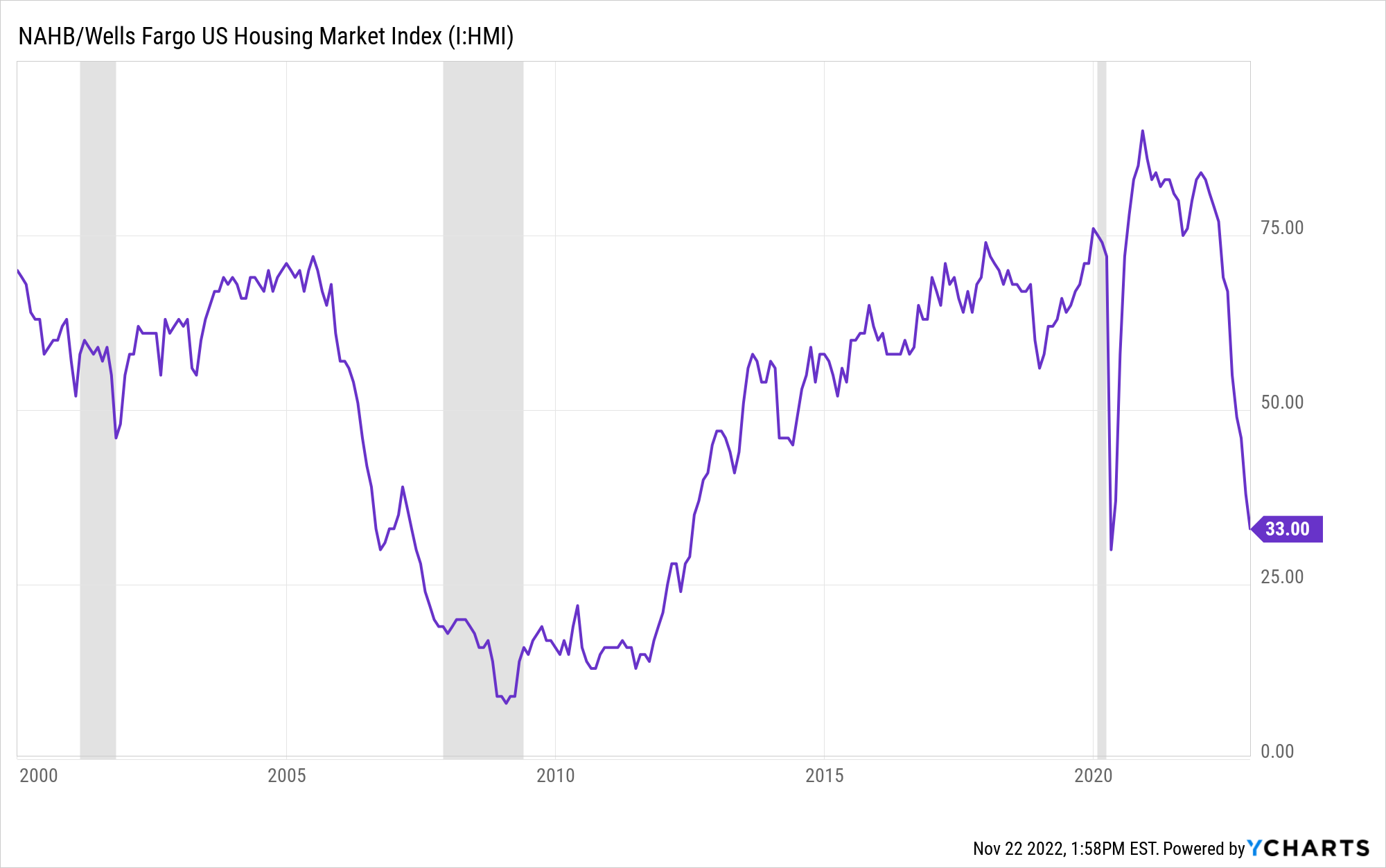

The graphs below show this. The Case-Shiller Home Price Index measures the price of homes, US Existing Homes Supply measures the homes that are available for sale, and the NAHB/Wells Fargo Index measures buyer traffic in the market. Take a look at where all of these numbers were at the end of 2010:

Looking at these graphs, it’s clear to see why home prices fell after 2008. Supply skyrocketed (thanks to the amount of foreclosed homes and years of new homes being built to satisfy overinflated demand) and demand fell drastically.

Supply and Demand In 2022

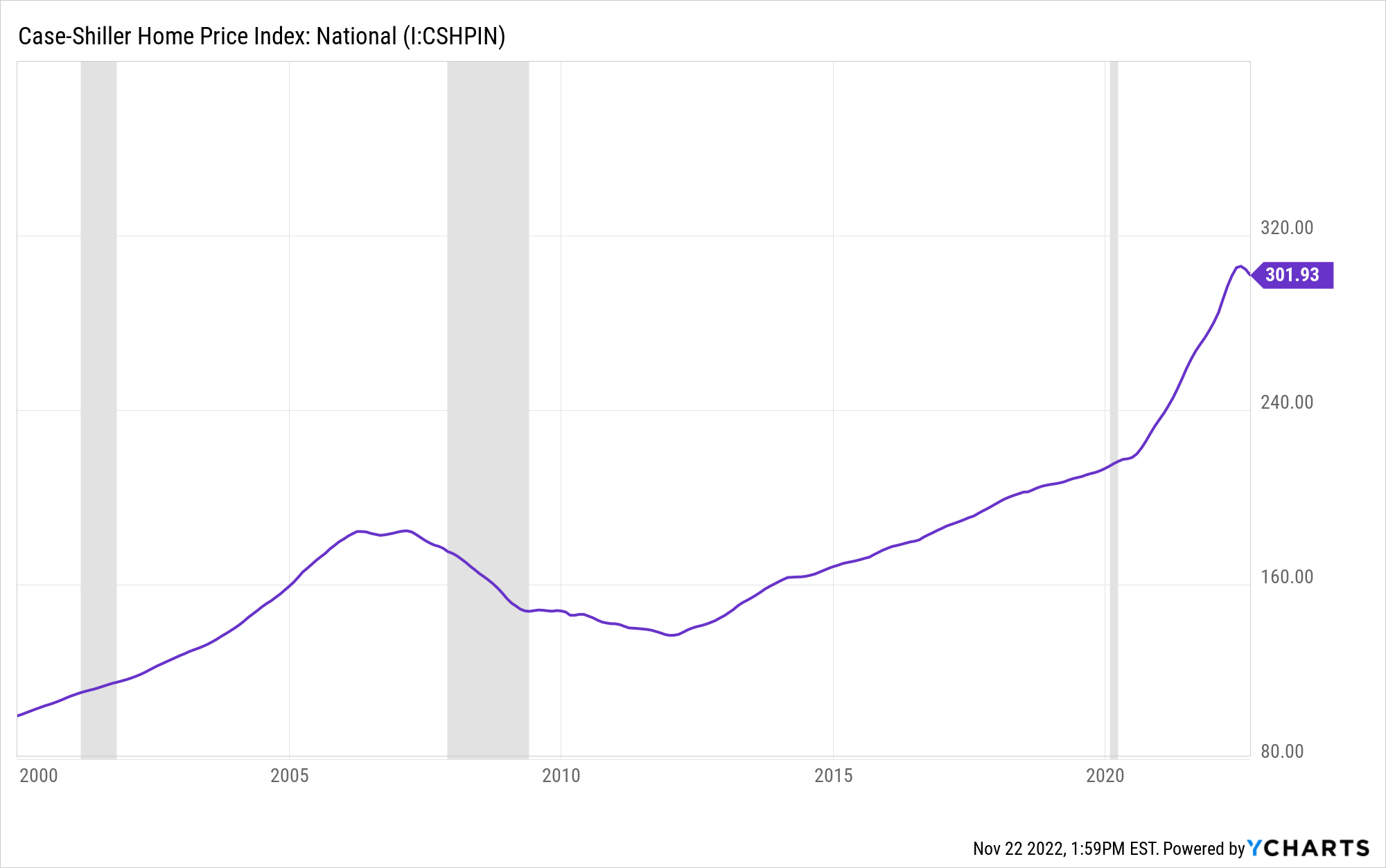

Now let’s take a look at where these numbers are today:

The NAHB index is at 33 today, which is down from where it was throughout 2021, but above where it was when prices declined in the late 2000s (when it was under 20). This decline is a mixture of seasonal demand dipping during the winter months and higher interest rates making housing unaffordable for some.

Despite all that, the desire to buy a home is still more than double what it was when home prices last fell.

Now take a look at supply. There are currently only 1.22 million homes for sale in the US. Looking back, you can see that this number is shockingly low compared to the previous decade.

And to make matters worse, that number does not truly reflect the amount of homes that are actually available for sale.

The Existing Home Sales report includes homes that are marked as both “active listings” and “under contract”. In October, there were only 754,000 active listings, which means that 38% of the “inventory” in the Existing Home Sales report was under contract and not truly available. This speaks to demand, as a normal market has 25% of inventory under contract, according to MBS Highway.

A lot of people are concerned about the falling demand for homes, but by looking at supply and demand today compared to what it was following 2008, it’s clear that we have more than enough eager buyers to support home prices.

The Bottom Line

Home prices rarely go down. And when they do, it’s not by much. To see a repeat of the 2008 crash, we would need a lot of external forces at play that are just not present today.

Yes, prices have dipped slightly in some areas of the country, but a decline this small is hardly a cause for panic especially considering that fact that prices have risen 20% in the last year alone. Once interest rates drop, demand will skyrocket once again and prices will continue on their usual upward trajectory.

What does this mean for your homebuyers? If they can afford it, now is a great time to buy. The chances are very high that they will be able to get a great deal on a home and more favorable terms on their mortgage if they buy within the next few months. Once winter is over and rates are even lower, competition will increase and prices will go up.

Remember, wealth is not created by timing the market – it’s created by time IN the market. The sooner you buy a home, the sooner you will start building equity and be one step closer to financial freedom.

Not to mention, homeowners today have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. With the pandemic and the forbearance program, many people were able to stay in their homes and work out alternative options.

And for those homeowners who still need to make a change due to financial hardship or other challenges, today’s record level of equity is giving them the opportunity to sell their houses and avoid foreclosure altogether. That’s why there won’t be a wave of foreclosures coming to the market.

Submit a comment