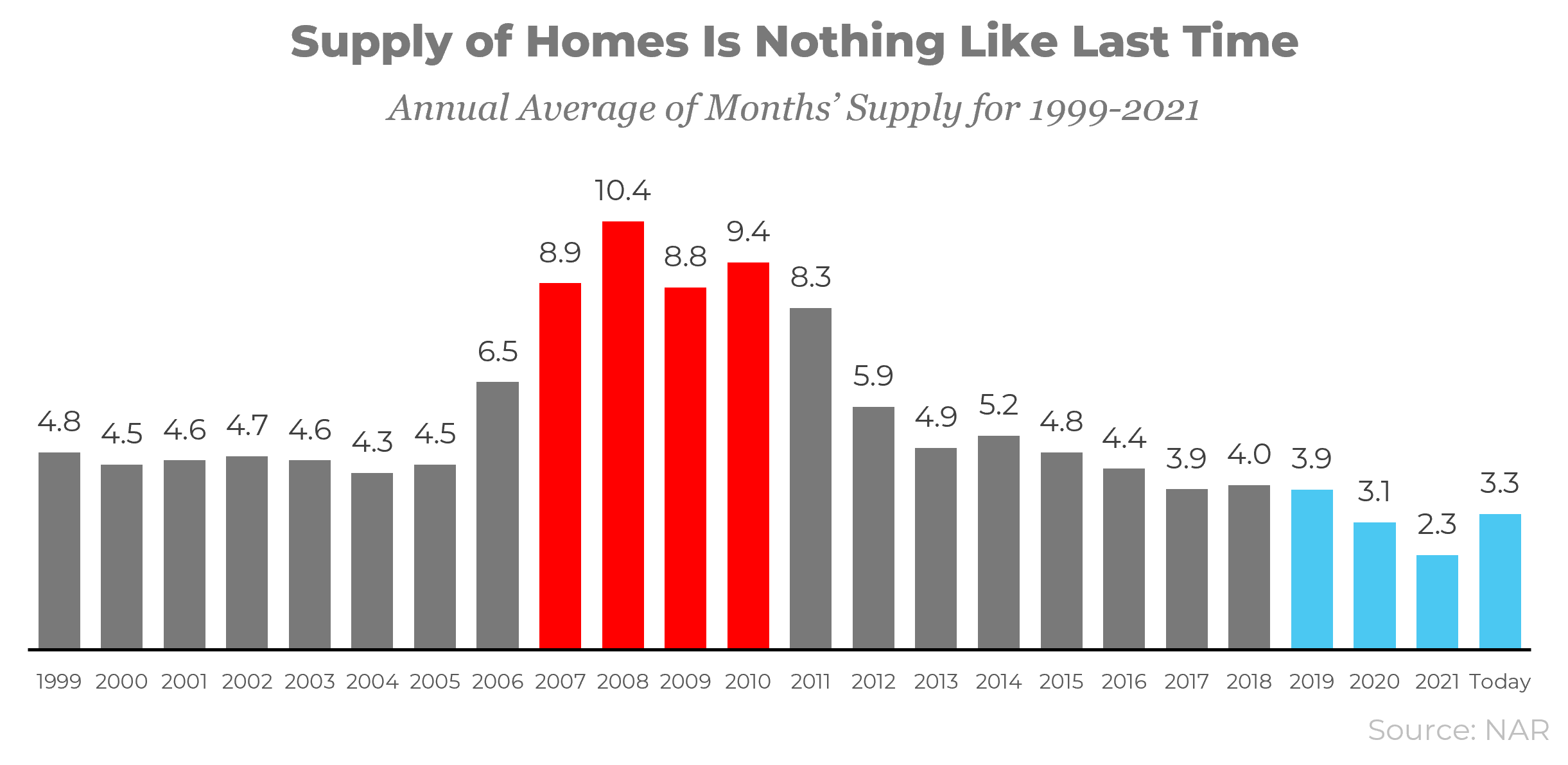

There’s a Shortage of Homes on the Market Today – Not a Surplus

The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will cause prices to fall. Anything less than that is a shortage and will lead to continued price appreciation.

For historical context, there were too many homes for sale during the housing crisis, and that caused prices to tumble. Today, supply has grown, but there’s still a shortage of inventory available (see graph below):

One of the reasons inventory is still low is because of sustained underbuilding. When you couple that with ongoing buyer demand as millennials age into their peak homebuying years, it continues to put upward pressure on home prices. That limited supply compared to buyer demand is one of the reasons why experts forecast, nationally, home prices won’t fall this time.

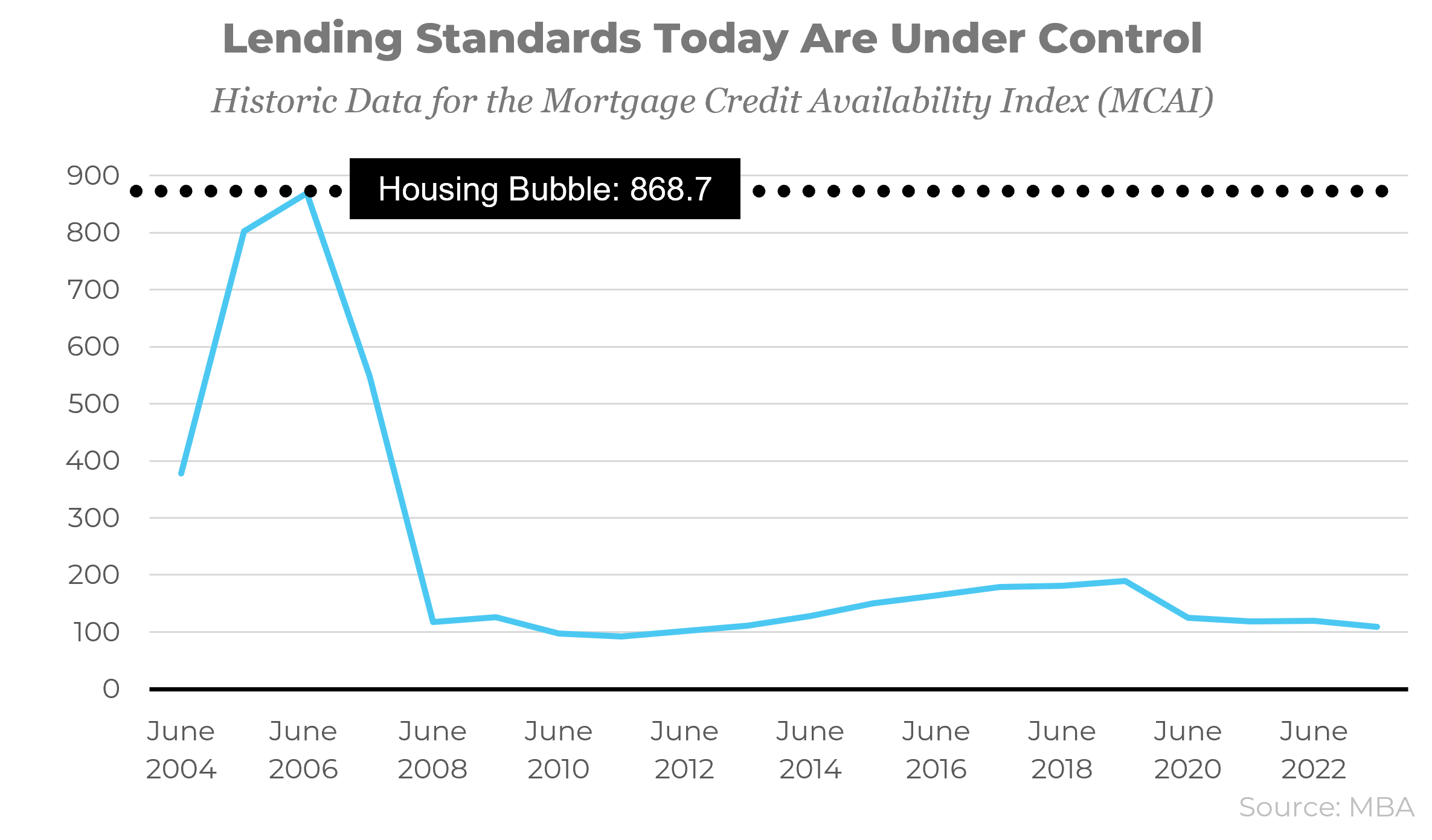

Mortgage Standards Were Much More Relaxed During the Crash

During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. The graph below shows data on the Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers Association (MBA). The higher the number, the easier it is to get a mortgage.

Leading up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. That led to mass defaults, foreclosures, and falling prices.

Today, things are different. Purchasers face much higher standards from mortgage companies, and buyers are more qualified. Mark Fleming, Chief Economist at First American, says:

“Credit standards tightened in recent months due to increasing economic uncertainty and monetary policy tightening.”

Those stricter standards help prevent a wave of foreclosures like we saw last time.

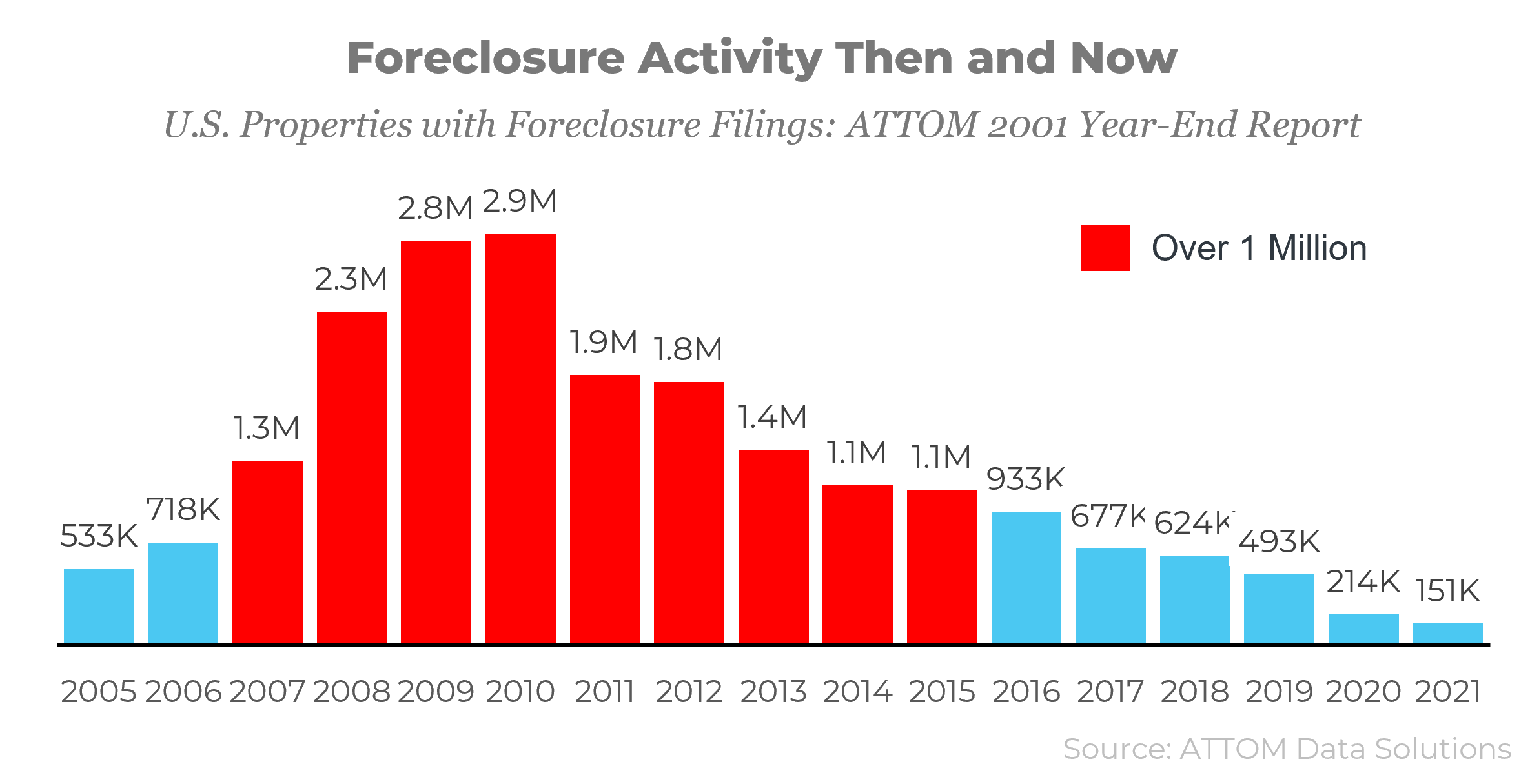

The Foreclosure Volume Is Nothing Like It Was During the Crash

The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. Foreclosure activity has been on the way down since the crash because buyers today are more qualified and less likely to default on their loans. The graph below helps tell the story:

Not to mention, homeowners today have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. With the pandemic and the forbearance program, many people were able to stay in their homes and work out alternative options.

And for those homeowners who still need to make a change due to financial hardship or other challenges, today’s record level of equity is giving them the opportunity to sell their houses and avoid foreclosure altogether. That’s why there won’t be a wave of foreclosures coming to the market.

The Bottom Line

If your homebuyers are worried we’re making the same mistakes that led to the housing crash, these graphs should help alleviate their concerns. Use this data to ensure they feel safe to get into a home now. These numbers show that the housing market is still severely under supplied for the amount of demand. This means the market is still very strong and that home prices will continue appreciate.

Submit a comment